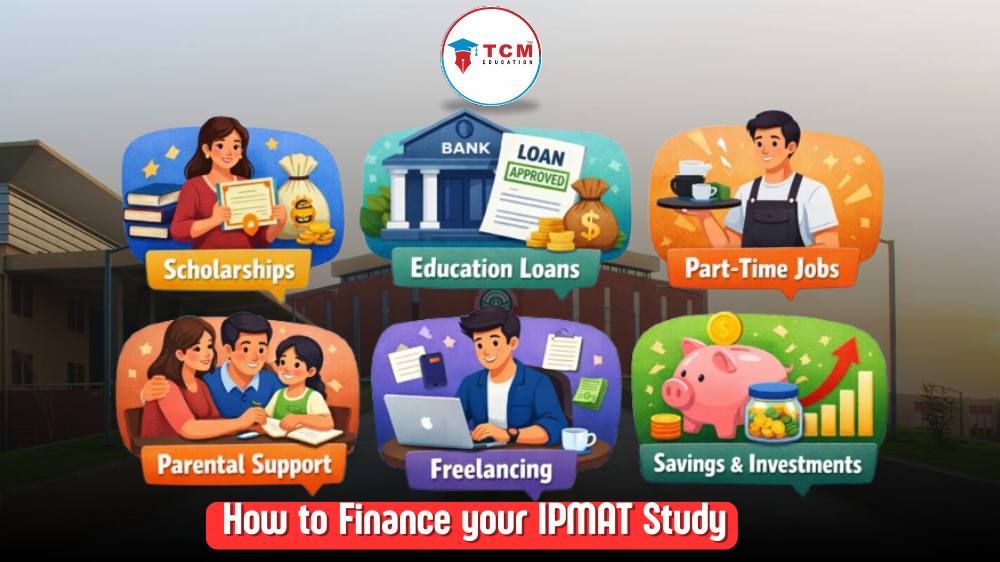

How to Finance Your IPMAT Study

Overview

Concerned by the fees to attend some of the best learning institutions such as IIM Indore or IIM Rohtak integrated program in management? This blog is for smart decision making in the field of money,look for scholarship or learn how to reduce the wastage of money

Introduction

While getting ready for the IPMAT is thrilling, paying for college can seem intimidating. Be at ease! Tuition costs, living expenditures, and other financial obligations can be lessened with the appropriate financial planning and techniques. We'll guide you through it all in this blog, from government assistance to scholarships, so you can concentrate on your education rather than your bank account.

Understanding the Cost Puzzle

Before we dive into the different ways to fund the IPMAT studies;lets break down the expense

· Entrance preparation fess:

· Tution fees

· Living expenses

· Other costs

Unlocking Scholarship Doors

Performance Pays: Merit-Based Scholarships

Showcasing stellar academic performance? Many institutes, including IIM Indore and IIM Rohtak, reward top-performing students with merit-based scholarships.

Support When You Need It: Need-Based Scholarships

Need-based scholarships, such as those from the Ministry of Education or IIM-specific initiatives, can intervene to provide much-needed assistance if financial obstacles are in the way.

Corporate Sponsors: Private Scholarships

Private organizations like Aditya Birla and OP Jindal offer scholarships for management aspirants, helping them pursue IPM without the stress of hefty fees.

Smart Borrowing: Education Loans That Work for You

Bank Loans: Traditional and Trustworthy

For IIM students, the majority of big banks, including SBI, HDFC Credila, and Axis Bank, provide liberal terms on education loans. Interest rates typically range from 8% to 10%, and payback terms start six to twelve months following graduation.

NBFC Loans: Flexibili1ty in Financing

Avanse and InCred are two examples of non-banking financial institutions (NBFCs) that are stepping up to offer flexible education loans with more convenient terms and repayment choices.

Government Schemes: Interest-Subsidized Loans

Don't disregard government-backed loan programs intended to assist students from economically disadvantaged backgrounds, such as the Central Scheme for Interest Subsidy (CSIS) or the Vidya Lakshmi Portal.

Govt Aid & State Programs: Hidden Gems

Did you know states like Maharashtra offer 100% fee waivers for ST students? Many state governments have similar schemes to make education more accessible. Keep an eye on both state and central government programs to make the most of available financial support.

Earn While You Learn: Jobs & Internships

Campus Jobs: Get Paid for Helping Out

Part-time jobs on campus, from tutoring to research assistance, offer the perfect way to earn while staying focused on your studies.

Paid Internships: Money and Experience

Many companies offer paid internships for management students, giving you both financial relief and valuable industry experience.

Money-Saving Hacks: Cut Costs, Not Corners

· Budget Wisely: Keep track of every rupee to avoid unnecessary expenses

· Share and Save: Sharing accommodation and resources like books or transportation

· Use Student Discounts:Ask for discounts wherever you can .

Conclusion

The key to fund your IPMAT coursework is careful planning. There are many strategies to lessen financial stress,Achieving your academics objective withput over budget requires being proactive,seizing every opportunity